- cryptosp

- moneyfx pro

Offline

Offline - From: Bangladesh

- Registered: 10/20/2020

- Posts: 1,617

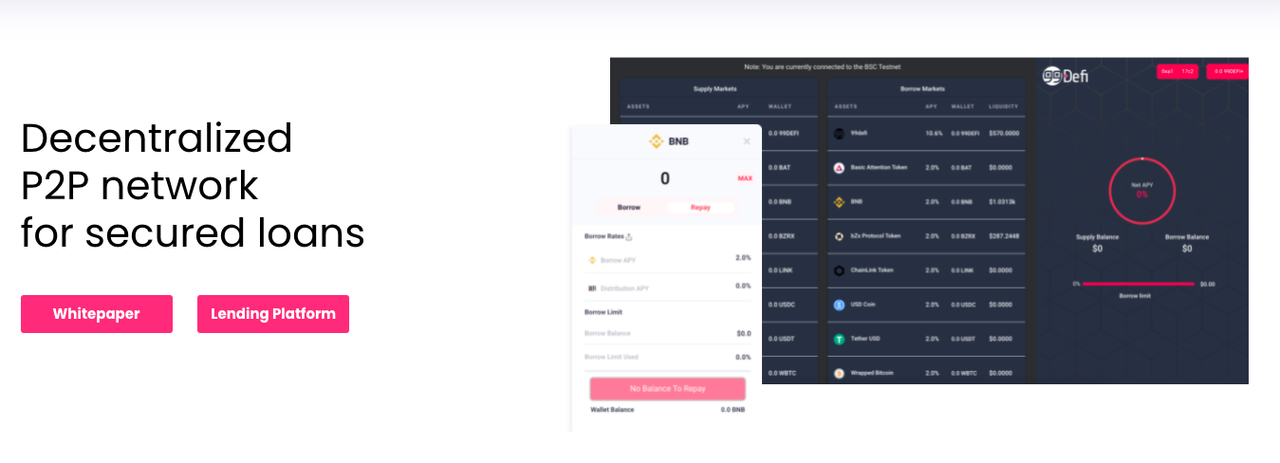

99DEFI Platform on BSC Network !

How Does Compound Finance Work in 99DeFi?

The current DeFi landscape, lending, borrowing, staking, and mining crypto assets are fragmented and have created painful experiences for participants. There is a need to aggregate liquidity, facilitate, and automate crypto asset trading with security and efficiency and provide insights into risk and portfolio management.

99DeFi delivers smart crypto trading through:

Trading assets via global liquidity aggregate with access from centralized exchanges (CEX), and decentralized exchanges (DEX).

Smart lending, borrowing, staking, mining through artificial intelligence-driven smart yield farming aggregators.

Even more, 99DeFi does not require users to give private keys and operates under a compound shared security model, ensuring high resilience.

A Future Based on More Truth and Less Trust

99DeFi is a non-custodial, decentralized network governed by 99DeFi token holders via decentralized autonomous organization (DAO). Its protocol offers incentives for users to join the network with an efficient fiscal spending regime, managed by a treasury.

The platform addresses the market of cryptocurrency trading and yield investments, and specifically DeFi market platform. Also, it is a liquidity aggregator from DEX, CEX, liquidity pools, and other sources into one global pool enabling order flow to enter a single point.

99DeFi functions as a yield engine, which abstracts away execution complexities of opportunities in DeFi, allowing ease of access to retail investors, fund managers, and serves as a gateway to the DeFi landscape. The platform provides decentralized lending in the crypto world, without being exposed to loss of loan capital.

Furthermore, 99DeFi provides access to the loan market globally, without intermediaries. 99DeFi provides a solution for securing loans by providing smart contracts which require collateral from the borrower.

99DeFi consists of three components:

Global liquidity aggregator

Users will be able to trade assets on 99DeFi through aggregate liquidity sourced from centralized and decentralized sources.

Smart yield farming aggregator

The second component of 99DeFi protocol, is the machine learning and AI-powered DeFi smart yield farming aggregator.

Smart asset management

The third aspect of 99DeFi that sets the platform apart is a set of portfolio management features available to users, acting as a complement to 99DeFi global liquidity aggregator and smart yield farming aggregator.

99Defi supports the following assets:

Stablecoins: USDC, USDT, TUSD,

Synthetic tokens: cTokens, yTokens

Hybrid Tokens: wBTC

Coins and tokens: ETH, BAT, Ox, LINK

99Defi intelligence engine is an off-chain oracle sourcing intelligence into on-chain DeFi proxy smart contracts. It uses data to divide assets and investment opportunities into allocation baskets sorted by the duration of exposure or risk value.

99Defi’s operating system monitors and shapes the landscape in real-time, and dynamically rebalances and adjusts basket algorithmically.

To Wrap It Up

99DeFi will be the first cross-chain DeFi yield engine and liquidity aggregator. The platform wants to leverage a scalable network so gas fees can be kept to a minimum and not eat into the profit of users yield farming or staking.

Also, 99DeFi features its native utility token, the 990DeFi token. Even more, it utilises compound proof of stake-based consensus mechanism as a base consensus algorithm.

Twitter:

Telegram Announcements:

Platform Url :

1 of 1

1 of 1